**UPDATE – PSR update through October 2019 on 11/5/2019**

- Q3 2019 industry orders were 38% below Q2 2019 and 70% lower than a year ago when UP and NS announced PSR.

- In 2018, the industry ordered 77,478 railcars. That figure will decrease—due in part to PSR—to an estimated ~37,000 railcars.

- Q3 2019 industry book-to-bill was 0.50; Q3 2018 book-to-bill was 2.23.

- UP’s headcount declined 12.9% y/y in September vs. -10.8% and -9.2% in August and July.

- Norfolk Southern (NS) headcount reductions accelerate. NS’s headcount declined 9.3% y/y in September vs. -7.0% and -5.4% over the prior two months.

- Kansas City Southern (KCS) headcount slightly lower. We continued to see more aggressive headcount reductions from the larger U.S. Class I railroads.

- Total railcars in storage increased 4.6% m/m during September. Since January, a total of 66,255 railcars have been moved into storage

Navigating Precision Scheduled Railroading

Union Pacific, Norfolk Southern and Kansas City Southern are the newest Class I railroads to implement their own versions of Precision Scheduled Railroading (PSR). While shippers may look forward to the promise of faster delivery and improved customer service in the long term, it’s still a big change to operations in the short. And when each network has their own brand of PSR, it’s bound to be difficult to navigate that change.

At Greenbrier we not only build the railcars that move economies, we lease and manage them too. That’s our Integrated Business Model, and it gives us a unique vantage to understand the ins and outs of PSR and what it all means for our customers.

For the past decade, we have been tracking all of Hunter Harrison’s implementations of PSR at Canadian National, Canadian Pacific and CSX. Each of them has seen success. After implementing PSR in 2017, CSX has lowered their operating ratio to 57.4% in Q2 2019.

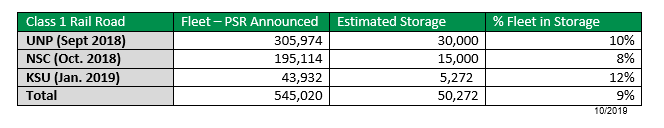

PSR Fleet

These numbers only show the beginning of the progress the Class Is are banking on. Every network is focused on improving their operating ratios to 60% or lower in the next few years, and they all have different plans on how to get there. CN is now expanding their PSR goals, setting their sights on an operating ratio of 56% and planning to hit that number by 2022 through automated railcar and track inspection systems. UP has a regional approach in their northeast and southeast corridors for their 60% operating ratio goal by 2020. NS is focused locally on specific yards to reach their 60% goal by 2020. And KCS plans to get to their 60% target by 2021 through incremental implementation, combining intermodal and merchandise traffic.

Improvements on operating ratios mean faster deliveries for shippers, but they also mean a host of new fees and demurrages. To incentivize quicker returns, UP and NS are now charging $150 per day per empty railcar not returned after 24 hours. Fees like this can be a surprise for shippers who can’t keep track of how each network is changing.

Going Strong With Greenbrier

We’re here to help. Greenbrier is a leading supplier of freight transportation equipment and services that power global markets. We manage over 378,000 railcars and maintain a steadfast commitment to our customers.

While our Integrated Business Model gives us a deep understanding of how the different Class I railroads operate, we’ve also managed our own fleet for the past 30 years. That experience allows us to deliver value to customers at a level that’s difficult for anyone else in the industry to duplicate.

As the best-in-class railcar management solutions provider in North America, we have the right expertise to guide our customers through any new challenges, improvements and logistics ahead.

Find out more about how our team can help guide you through PSR.