Update as of 4/20

- In April 2020 OPEC+ countries have agreed production cuts to mitigate the global oil supply glut; to Saudi Arabia, Russia and the U.S. are among the countries that agreed to cut production. In total, 23 countries agreed to curb collectively 9.7 million barrels a day of oil from global markets.

- Although these countries agreed to production cuts, the decline in demand has already taken place and therefore to slow the price decline, supply needs to be below or at equilibrium with demand.

- Saudi oil shipments to the U.S. have nearly quadrupled since February to a 1.46 million barrels per day in the first two weeks of April, which has added to the supply glut.

- More exacerbating news is that 20 Saudi tankers are headed to the U.S. gulf carrying 40 million barrels of crude oil for an expected arrival in late May.

- The latest WTI forecast in April by the EIA forecasted West Texas Intermediate (WTI) to average $29.34 in 2020, which is down from an average of $57.02 in 2019. This forecast could be lowered in May’s WTI price outlook.

- In the start of 2020, WTI prices were roughly $60 per barrel. On April 20, 2020 WTI prices fell below $0 in one of the biggest sell offs in history.

- The May WTI futures price in Cushing-OK is getting effected as physical storage is getting full.

- On April 11, 2020 the most recent carloads for petroleum products fell ~19.5% for the week; carloads for petroleum products are up 7.5% year-to-date through April 11th.

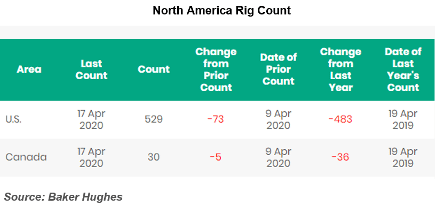

- North American rig count is down 78 rigs in the week ending April 11th versus the prior week with U.S. rigs being down ~52% from a year ago. Of the 30 Canadian rigs, only 7 are drilling oil while the remaining are drilling for natural gas.

The global impact of crude oil has been felt around the world. With demand at historic lows, the world’s top oil producers recently met to discuss an agreement on reducing production. Our Greenbrier economic expert breaks it down with the most recent information in our crude oil white paper.

Fill out the form below to download the full article.