Crude Market

Crude Production & Consumption

- Russia’s invasion of Ukraine has unsettled global crude and petroleum products supply, causing higher global crude prices.

- The Energy Information Administration (EIA) estimates that 99.4 million barrels per day of petroleum and liquid fuels were consumed globally in August 2022, up by 1.6 million barrels per day from August 2021.

- Forecast for global consumption in this category is expected to rise by an average of 2.1 million barrels per day for all of 2022 and 2.0 million barrels per day in 2023. Higher natural gas prices globally have led the EIA to increase its forecast for oil consumption in Q4 2022 through Q1 2023, as European electricity providers may switch to oil-based generating fuels.

- According to the EIA, U.S. crude oil exports through the end of August were 4 million barrels per day, up from 3 million from a year ago. Production for the same period rose to 12 million barrels (up 1 million barrels). Exports and production have increased due to global supply shocks.

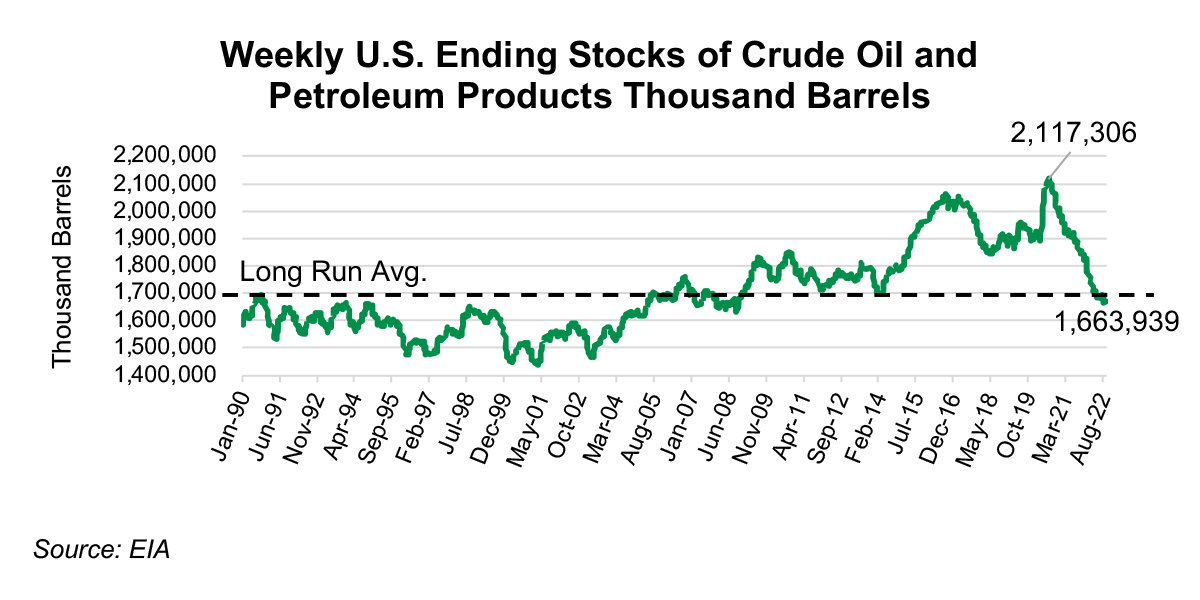

- After hitting a peak in July 2020, U.S. crude inventories have decreased by ~453.0 million barrels (-21%) in 2022 (see chart below). Furthermore, in April, crude inventories fell below the long-run average and have continued to decline, suggesting elevated crude prices could remain through at least 2024.

- The EIA estimates that U.S. crude oil production will increase to 12.2 million barrels per day in Q4 2022 and will rise to an average of 12.6 million barrels per day in 2023, setting a record for the most U.S. yearly crude oil production. The current record is 12.3 million barrels per day in 2019.

- Because domestic consumption and production will be in equilibrium and exports are expected to grow, production will be at a deficit.

West Texas Intermediate (WTI)

- WTI oil price, through the end of August, has averaged $101 per barrel, which is up $37 (57%) compared to 2021. WTI peaked at $123 per barrel in March during the beginning of the Russia-Ukraine war.

- The last time prices were averaging over $100 per barrel was in 2014 and crude inventories were around the long-run average. There could be another spike in the WTI price beginning in Q4, as this is when the European Union will significantly reduce its imports of Russian oil.

- The EIA forecasts WTI crude oil price to average $98 per barrel in 2022 and $91 in 2023.

RIG Count, Railcar Storage & Loadings

- S. rig count through the end of August was 760 units, up 252 units (+50%) from a year ago.

- Through August, there were 42,000 crude and ethanol tank cars in storage, down about 7,500 units

(-15%). Current crude and ethanol railcar utilization as of August 1 was 76%, an improvement from a year ago. Utilization improved due to higher crude oil prices from increased domestic demand and supply constraints due to the Russia-Ukraine war. - Although crude railcar loadings are expected to be flat in 2022, if loadings—with respect to inventories and prices trend like 2014 (the last time inventories were at the long run average)—then loadings could grow 5% to 10% through 2024.

Fill out the form below to download the full article.