Introduction

Introduction

The importance of the North American Free Trade Agreement (NAFTA) to both the North American freight rail industry and the broader trade-member economies is immense. More than $1 trillion in goods and services are traded between Canada, Mexico, and the U.S. every year. All member countries are top trading partners with each other, and from a U.S. perspective, NAFTA-related trade accounts for roughly 33 percent of exports and 27 percent of imports.

On August 16, 2017, negotiators from Canada, Mexico, and the United States commenced talks to modernize the 23-year old agreement. Greenbrier has been closely following NAFTA negotiations as they have evolved, as the outcome could have implications for our business, our customers, and our people. The American Association of Railroads (AAR) estimates that international trade provides 50,000 domestic jobs, with total annual wages in excess of $5.5 billion. Additionally, roughly 42 percent of freight rail loadings and more than 35 percent of annual freight rail revenue are directly dependent on international trade. Finally, U.S. rail export revenue and tonnage consistently exceed import revenue and tonnage, contributing to a smaller overall U.S. trade gap.

Due to NAFTA and a lack of any true geographically-defined borders between NAFTA countries, there is effectively no such thing as an independent U.S. freight rail network. The freight rail industry is structured as an integrated North American enterprise, with uniform standards for railcars, cross-border connecting rail lines, and railroads that own and operate thousands of miles of track in multiple countries. Increasing NAFTA trade barriers would require significant changes to railroad operations, as well as a substantial re-imagining of the North American freight rail network, which would result in increased costs, fewer jobs, lower efficiency, slower shipping, and reduced global competitiveness.

The North American freight rail network is highly integrated.

For these reasons, our stance is that a revision of NAFTA should preserve the benefits of the existing agreement, while still modernizing it to refine rules of origin, which prescribe content requirements for NAFTA goods, and to strengthen environmental and labor provisions.

As Union Pacific Railroad’s CEO, Lance Fritz, commented recently on NAFTA negotiations, “the best step our government can take is to create a climate in which businesses have the confidence to invest and create jobs.”

NAFTA Negotiations

The current trilateral NAFTA negotiations are significant in that they will offer the first substantive insight into the Trump Administration’s broader trade policies, which have been the object of some apparent contradictions among the President’s economic policy team. A “new NAFTA” could serve as a model for this administration’s trade policy, and will likely be a template for other agreements and trade policy actions during the President’s term.

For the past several months, Greenbrier has actively monitored and participated in public NAFTA forums with the Office of the U.S. Trade Representative (USTR), U.S. Chamber of Commerce, National Association of Manufacturers, and U.S. Department of Commerce. During this process the business community rallied around a mantra, “do no harm,” which was echoed in Congress and throughout the Administration.

The NAFTA partners have established an aggressive timeline for negotiations. Following the opening round of negotiations on August 16th, they have outlined a schedule that will require meeting every three weeks, rotating locations among the three NAFTA countries.

Due to the Congressional consultation requirements, other administration priorities and legislative deadlines, and desire for transparency from stakeholders, this timeline may prove to be overly ambitious. Nonetheless, officials are interested in moving quickly. Canada and the U.S. recently reiterated a shared goal in a telephone call between President Trump and Canadian Prime Minister Justin Trudeau on August 31 to wrap NAFTA negotiations by year-end.

Although the Administration seeks a comprehensive renegotiation, it also confronts structural challenges that could impede progress. However, the pace of negotiations may be buoyed by the use of existing trade agreement language. Negotiators have found that some existing NAFTA text is state-of-the-art in many ways, and can be reused. In addition, there are elements of the Transpacific Partnership (TPP), Trade Facilitation Agreement (TFA), Transatlantic Trade & Investment Partnership Agreement (TTIP), and Trade in Services Agreement (TiSA) that can be accessed to improve NAFTA.

A driving force in these negotiations is the Administration’s laser focus on trade deficits. The Administration is looking broadly at trade policy for remedies that trade agreements could offer to combat deficits. Currently, the United States has a goods trade deficit and services surplus with Mexico.

NAFTA Negotiations Timeline

August 16-20: The first round of NAFTA negotiations in Washington, D.C.

September 1-5: The second round of NAFTA negotiations in Mexico City.

September 23-27: The third round of NAFTA negotiations in Ottawa.

September 5: Congress returns from August break

September 30: Congress must pass a government spending bill or face a government shutdown in October.

Fall 2017: Foreign Minister Luis Videgaray, Mexico’s lead NAFTA negotiator, must decide whether he intends to seek the presidential nomination for his party, the ruling PRI.

December 10: World Trade Organization Ministerial Meeting in Buenos Aires, Argentina.

Winter 2018: The Mexican and U.S. governments hope to wrap up negotiations by the first quarter of 2018, due to upcoming Mexican elections.

February 2018: Mexico must conclude negotiations or pause for elections.

March 2018: Congress must raise the debt ceiling or the U.S. risks default.

June 30, 2018: Trade Promotion Authority expires unless President Trump requests a three-year extension.

July 1, 2018: Mexican presidential election.

November 6, 2018: U.S. midterm elections.

December 1, 2018: Inauguration Day for Mexico’s new president. If a deal hasn’t been reached by then, NAFTA talks could pick up again under the new Mexican government by late 2018 or early 2019.

Areas of Interest

Rules of Origin

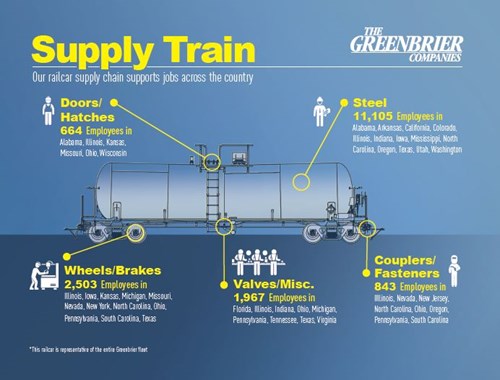

Rules of origin provide the basis for customs officials to make determinations about which goods are entitled preferential tariff treatment under NAFTA—products that are genuinely made in the United States or North America. The rules also exist to ensure that NAFTA’s benefits are not extended to goods exported from non-NAFTA countries that have undergone only minimal processing in North America. Greenbrier uses 51 percent to 95 percent U.S. components in all of our railcars built in North America.

In the negotiating objectives, USTR states it will strengthen the rules of origin and focus on promoting cooperation with NAFTA countries to ensure that goods that meet the rules of origin receive NAFTA benefits by preventing duty evasion and combat customs offenses by companies situated in non-NAFTA countries.

An update to NAFTA’s rules of origin should expand market access for U.S. companies and increase U.S. competitiveness globally.

Labor Standards

The NAFTA negotiating objectives are in line with the framework established in TPA and utilized in TPP. USTR will bring labor provisions into the core of the Agreement rather than in a side agreement—making labor standards enforceable for all NAFTA members and subject to sanctions. The AFL-CIO is urging for a restructured NAFTA to raise workers’ wages, especially in Mexico.

Environmental Standards

USTR will bring environment provisions into the core of the Agreement, rather than in a side letter—making them enforceable for all NAFTA members and subject to sanctions. Leading environmental protection organizations have labeled the negotiating objectives as a polluter-friendly deal, and are seeking to bolster climate protections in NAFTA by penalizing imported goods made with high-climate emissions.

There are similarities in the NAFTA approach with those pursued in TPP, but details remain scarce. The objectives make clear that NAFTA will do the following:

- Establish rules that will ensure that NAFTA countries do not waive or derogate from the protections afforded in their environmental laws for the purpose of encouraging trade or investment.

- Establish rules that will ensure that NAFTA countries do not fail to effectively enforce their environment laws through a sustained or recurring course of action or inaction, in a manner affecting trade or investment between the parties.

- Require NAFTA countries to adopt and maintain measures implementing their obligations under select Multilateral Environment Agreements (MEAs) to which the NAFTA countries are full parties, including the Convention on International Trade in Endangered Species of Wild Fauna and Flora.

State-Owned and Controlled Enterprises

China has recently pushed into the North American freight and passenger railcar market by means of state-owned enterprises that enjoy limitless financing from the Chinese government, thereby inoculating these entities from traditional markets forces such as the cost of capital. In the negotiating objectives, USTR states that it will ensure impartial regulation of SOEs and provide jurisdiction to courts over the commercial activities of foreign SOEs— thereby limiting the infiltration of Chinese state-owned enterprises into the North American rail market, among others. The approach toward SOEs in the current NAFTA renegotiation closely mirrors that undertaken in TPP.

Dispute Resolution: Chapter 11 and 19

NAFTA’s Chapter 11, the Investor-State Dispute Settlement (ISDS) chapter, attempts to provide a basic rule of law for investors doing business in foreign countries. ISDS establishes an impartial, law-based approach to resolve conflicts in the event of discrimination, expropriation, denial of justice, or prohibition to move capital. Claims are brought before international arbitration panels to resolve investment conflicts without creating state-to-state conflicts. President Trump wants to repatriate dispute resolution into the domestic legal system and out of the hands of international tribunals.

Chapter 19 is another dispute resolution mechanism that allows an independent, binational panel to settle disputes about illegal subsidies in anti-dumping and countervailing duty cases; the panel has frequently ruled against the U.S. The Trump Administration is working to eliminate the panel during negotiations. However, Canadian Prime Minister Justin Trudeau stated that a fair dispute resolution system is essential for Canada to sign a new NAFTA agreement. Canada’s primary trade negotiator, Chrystia Freeland, has suggested that Canada could walk away from the negotiating table if the U.S. pushes to remove the dispute-settlement mechanism.

Our Stance

Our view is similar to that of many in the freight rail industry, including Kansas City Southern Railroad CEO Patrick Ottensmeyer, who says,

“We believe the focus should be on enhancing the job-sustaining flow of trade across our borders; avoiding the high tariffs and other trade barriers that preceded NAFTA; following the procedures established in the Bipartisan Congressional Trade Priorities and Accountability Act of 2015; and proceeding quickly and trilaterally. U.S. negotiators should be careful to do no harm to the critical trade among the NAFTA trading partners that is so vital to U.S. exporters today […]”

We would like to echo our freight rail partners’ comments and add that NAFTA has had a positive impact on our company, our suppliers, and the U.S. economy as a whole. Maintaining the current provisions, particularly North American market access, is critical to Greenbrier’s ability to conduct international business, especially in Mexico. We believe that a revision of NAFTA should “do no harm” to the existing agreement, while still modernizing it to refine rules of origin and to strengthen environmental and labor provisions.