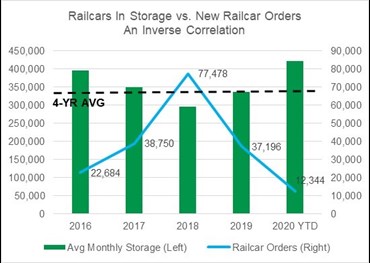

Fleet Oversupply

As of July 1, 2020, there were ~526,000 railcars in storage or 32% of the entire North American fleet. This is an all-time record high brought about by an unprecedented plunge in consumer demand and low oil prices. Although the figure is high, it begs the question: What is a normal monthly storage count in a good demand year? The 4-year storage average is ~340,000 units with industry orders averaging 44,000 units. As shown in the chart, storage and order figures have an inverse relationship. The industry would need to see the storage figure drop by roughly 200,000 units from current levels to drive normal order demand.

Keep in mind, some railcar types are likely to never be removed from storage as they are viewed as suboptimal, scrap candidates or in secular decline. There are over 80,000 coal cars in storage for over a year. There are also 50,000-grain hoppers and 12,000 boxcars idled with the vast majority near retirement age and/or with suboptimal payload capacity. The industry would benefit from increased scrapping of the railcars inching toward obsolescence.

Consumer demand will return as states reopen and certain railcar types will be pulled into service. Flatcars—closely tied to consumer products—have already seen increased demand. Vehicle and intermodal flats have seen the greatest increase with 30,000 auto racks and 8,000 wells expected to return to service over the next few quarters. Lumber traffic growth will also likely lead to further center beam activity in the months ahead. But by far, the Canadian grain hopper market seems immune to the COVID-19 pandemic impacts, as consumer demand has produced record carload levels.

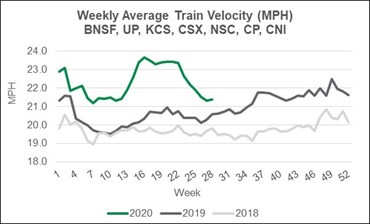

Precision Scheduled Railroading (PSR)

The other major headwind to new railcar demand is PSR. This operational philosophy has put downward pressure on railcar demand from returning to historic/normal levels. PSR impacts are evident in train velocity increases that have occurred over the last 18 months. For every 1 mile per hour (mph) increase, 50,000 fewer railcars are needed by railroads to service the freight. Through June 2020, the average velocity was roughly 2 mph faster than the same time last year. This equates to roughly 100,000 of the current 526,000 railcars in storage being attributed to PSR. PSR’s operational focus on asset utilization will continue to suppress new railcar orders overall until the equipment oversupply is reduced and freight levels rising significantly.