Freight Rail Growth in The Gulf Cooperation Council

Freight Rail Growth in The Gulf Cooperation Council

Nearly 200 years ago The United States began building out their freight rail network, and today that network spans over 140,000 miles. Prior to this, customers in the U.S. had limited options for buying goods from distant markets. Similarly, producers could only serve limited local markets unless they were located near a port. Today, one-third of all U.S. exports travel by rail, and millions of Americans work in industries that are more competitive in the global economy thanks to the cost competitiveness and productivity of freight rail.

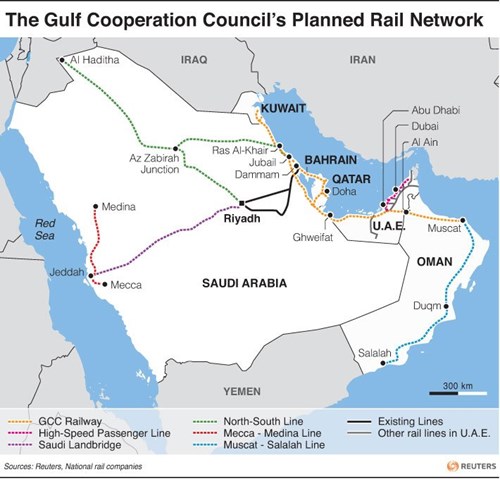

In the same way the United States’ economy has benefited from the expansion of the rail network, the Gulf Cooperation Council (GCC) countries plan to broaden their economies by building a connected rail network over the next several years. Comprised of Saudi Arabia, United Arab Emirates, Kuwait, Oman, Bahrain, and Qatar, the GCC is expected to add approximately 5,000 miles of track to the existing network, a 500% increase in capacity. Additionally, all new track is to be built to the same AAR standard that exists in North America. The most significant additions to the network will be the GCC Railway Network, which will connect Kuwait to Oman, and the Saudi Landbridge, which will connect the western port town of Jeddah, Saudi Arabia with the capital Riyadh, Saudi Arabia.

While the GCC’s expansion is modest when compared to the rail network in United States, it represents a significant economic opportunity to connect growing population centers, refineries, mining operations and intermodal transloading facilities by rail for the first time in GCC history.

Economic Diversification Opportunities in The Gulf Cooperation Council

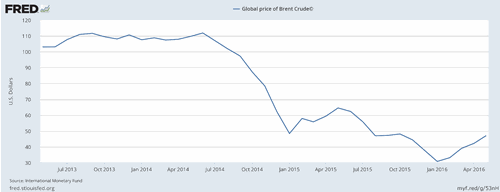

For decades, the GCC nations have depended on the production and export of crude oil to drive their economies, with estimates of oil revenue making up approximately 90% of the Saudi Arabian government revenue. However, with the sustained decrease in the price of oil over the past two years and the questionable long-term oil price outlook, GCC nations are looking for commercially viable ways to diversify their economies moving forward.

Low oil prices provide an incentive for increased economic diversification in the GCC.

Aside from crude oil, GCC countries are looking to capitalize on the following opportunities:

- Vast mineral deposits such as phosphate, aluminum, limestone and other industrial minerals. Saudi Arabian Mining Company, or Ma’aden. Ma’aden, the largest mining company in the region, is currently developing the world’s leading phosphate production facility, located in Northern Saudi Arabia. In 2014 through a partnership with Alcoa, Ma’aden built the world’s largest and most efficient aluminum processing facility at Ras Al Khair in Eastern Saudi Arabia. In 2015, Ma’aden shipped 5.5 million tons of phosphate, aluminum and other industrial products, and they stand to ship much more with the completion of their new phosphate facility and the expanded GCC rail network.

- Investments in refining facilities to process crude oil into other downstream, higher value petrochemical products such as sulfuric acid, propane and plastics. Saudi Arabia recently announced their ‘Vision 2030’ which, among other reforms, hopes to focus government leaders on diversifying their economic base away from crude oil production by the year 2030. Additionally, it was recently announced that the Saudi Deputy Crown Prince Mohammed bin Salman has appointed former Saudi Arabian Oil Company (Aramco) CEO Mr. Khalid al-Falih to take over as the head of Saudi Arabia’s oil ministry. Mr. Al-Falih has been tasked with leading the country’s diversification efforts and his appointment sent a very clear message that the government intends to focus on this new direction.

- Improving intermodal networks to more efficiently move freight and relieve congestion on the region’s highways. The port at Jebel Ali outside Dubai, U.A.E. is the world’s largest man-made port and currently the busiest port in the Middle East. Oman is also looking to expand their intermodal facilities and would benefit from a network connected to the GCC region. Having multiple transloading facilities in the region would create options for shipping lines and potentially drive down transportation costs as ports compete with each other.

Funding Freight Rail Opportunities in Middle East Gulf Countries

Clearly, the economic drivers and political motivation are there, but finding financing for these investment projects will require major shifts in business as usual. The total cost of all planned rail projects in the region is expected to exceed $200 billion, making the GCC rail investment one of the largest infrastructure spending projects per capita in the world.

In the short term, Aramco is considering listing 5% of its value on a stock exchange to raise funds in order to help stave off decreased oil revenues and finance continued infrastructure investments. While Saudi Arabia has the most at stake if oil prices remain low, the other GCC nations are making similar efforts towards facilitating non-energy sector investments. At the 2016 Middle East Rail Conference in Dubai, U.A.E. earlier this year, GCC nations, as well as Egypt, Morocco, and others were eager to find financial and operational partners to help with their ambitious rail expansion projects.

Greenbrier’s Booth at the Middle East Rail Conference in 2016

Greenbrier Excited to Partner With Middle East Freight Rail Stakeholders

In October 2015 The Greenbrier Companies announced an order from the Saudi Railway Company (SAR) for 1,200 tank cars. This marked Greenbrier’s entrance into the Middle East market, but the company’s path to serving customers on a global scale began much earlier.

Since establishing a reputation for quality and expertise in the North American freight railcar market, Greenbrier has expanded to Europe and South America to directly serve the freight transportation needs on those continents. While the operating regulations in Europe and South America are very different from those in North America, commodity producers require high quality railcars to reliably deliver their goods to customers no matter where they are in the world.

With customers in the GCC region and an office in Riyadh, Saudi Arabia, Greenbrier is excited to bring our quality railcar products and operational expertise to railroads, shippers and commodity producers in the Middle East during this time of rapid change and growth.