Macroeconomic Background:

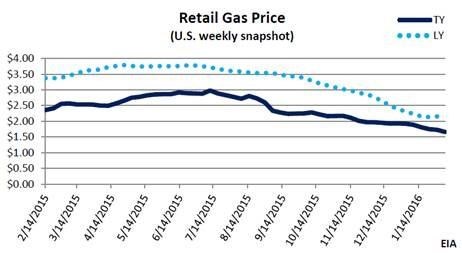

In 2015, auto producers sold a record 17.5 million cars and light trucks in the U.S, a 5.7% increase over 2014. The surge in demand was a result of both lower gas prices and a steadily improving economy from the 2008 recession. Barring an unforeseen recession or geopolitical shock to global oil markets, these trends should continue to be a tailwind for the North American auto industry.

Low gas prices are helping drive record auto sales.

Automotive Railcar Design:

Strong auto sales are good news for the rail industry since auto manufacturers use rail to move parts to their plants and to deliver finished vehicles to market. Cars and light trucks travel in automotive railcars, which are made up of two independent structures: an automotive flatcar (the base) and an automotive rack (the superstructure), each of which costs about the same as a general freight car.

Greenbrier’s Multi-Max™ Auto Rack + Flatcar

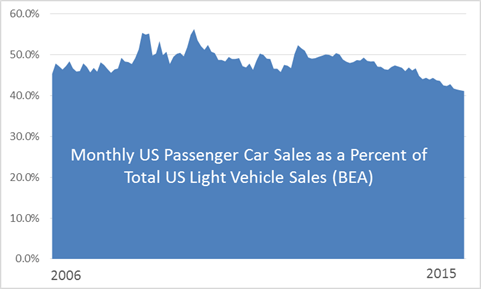

Auto racks are typically owned by railroads, while TTX owns the majority of auto flatcars. However, lessors and auto manufacturers (OEM’s) also buy some of their own equipment directly. Auto racks come in two distinct configurations: bi-level and tri-level. Bi-level racks are more spacious and accommodate larger vehicles such as SUV’s, trucks, and crossovers. Tri-level racks are designed to move smaller passenger cars such as sedans and hatchbacks as more of these cars can fit in a tri-level rack.

Greenbrier Innovations:

Due to fickle consumer preferences for vehicle sizes, railroads and OEM’s have historically found it difficult to properly anticipate their exact needs for bi-level and tri-level automotive railcars.

Consumer preferences for vehicle size can be somewhat volatile.

However, anticipating the prospective composition of automotive railcar fleets between bi- and tri-level configurations has become less of a problem since Greenbrier introduced the convertible-deck Multi-Max™ and Auto-Max II® railcars. Both of these auto carriers can transition between bi- and tri-level service with relative ease, which means owners no longer have to place bets on where future demand will come from (cars vs. trucks, vs. SUV’s vs. crossovers, etc.). In essence, these innovative railcar designs help make the rail transportation of autos more efficient and less capital-intensive.

The Auto-Max II® railcar also offers unique additional advantages, namely, an articulated design and a taller railcar clearance than what is standard in the industry. The articulated design allows autos to be loaded over the shared middle truck, increasing capacity, while the increased height accommodates a wider variety of vehicles in tri-level configuration, also increasing capacity.

A view from inside Greenbrier’s Auto-Max II®.

The above-average height clearance makes everyone happy.

As a result of these innovations, Greenbrier is the preferred supplier in the automotive railcar market and stands to benefit from continued demand for automobiles in the U.S., one of the strongest commodity groups in the freight rail industry today, and an expected economic bright spot going forward.

Customer Testimony

In the video below Honda explains some of the benefits of transporting vehicles by rail and how Greenbrier’s Auto-Max II® helps them do more with less.

Demand Dynamics:

At the most basic level, auto sales drive automotive railcar demand, but it isn’t always a constant linear relationship. Below the surface, a more nuanced picture emerges.

Consumer vehicle size preference is an important variable to consider. A preference for larger cars, as we’re seeing now due to low gas prices, means that railcars carry fewer autos per load (remember bi-level vs. tri-level). In concrete terms, a tri-level railcar might carry 14 vehicles, while a bi-level railcar might only be able to carry 9 vehicles due to their larger size, a 56% difference in unit-per-load carrying capacity. All else being equal, consumer preferences for larger cars helps boost automotive railcar demand.

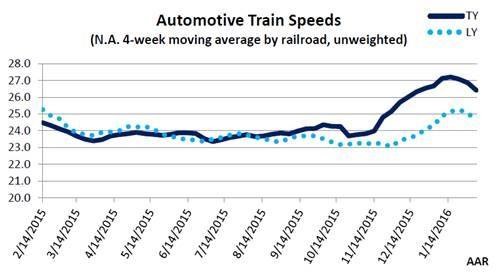

Another important factor to consider, and this is not unique to the automotive railcar market, is average rail velocity. Faster train speeds allow for more round trips per year, ultimately reducing the number of railcars required to move the same number of autos. Currently, average velocity is up due to lower freight demand in other commodity segments such as coal, but velocity could be showing signs of peaking. Improving velocity is one of the few headwinds in the automotive railcar market right now, but if overall rail freight demand turns a corner, as some forecasters are predicting for late 2016, velocity should give back some recent gains, which would benefit automotive railcar demand.

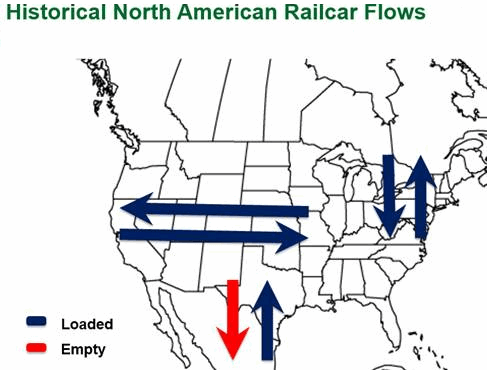

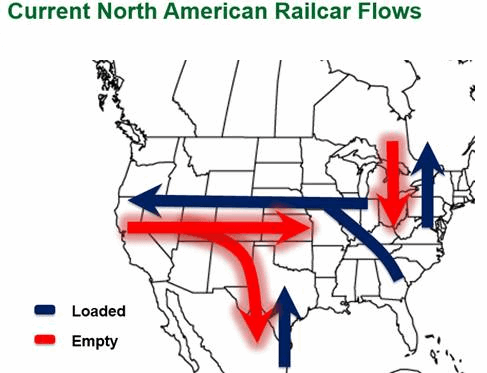

Lastly, the North American automotive market historically has been served by a combination of imports and production in the US Midwest and Canada. Railcars shipping from domestic sources to coastal markets were reloaded with Asian and European import vehicles back to points in the US. In recent years, however, manufacturers have shifted production away from the Midwest and Canada to the Southern US and Mexico, as illustrated in the maps below. Asian and European manufacturers have also shifted production to the US, which, in turn, has reduced the flow of product through coastal ports. The net effect of these changes is to increase the percentage of empty loaded miles, which in turn reduces network efficiency and requires more railcars to move the same volume of product.

Simplified for illustrative purposes.

Simplified for illustrative purposes.

Outlook:

Low fuel prices and a steadily improving economy are the two most fundamental drivers for automotive sales, and by extension, automotive railcar demand. According to the EIA, fuel prices should stay low for a long time. And while there have been some mixed economic signals lately, most forecasts for the U.S. show continued GDP growth.

Some auto forecasting groups expect U.S. auto sales to reach 18.2 million in 2018 and for North American production to climb to 18.8 million over the same period. Nearly all of this production will require railcars for transportation, including vehicles destined for export. If fuel prices remain low, consumer preferences for larger cars will likely persist. Automotive railcar velocity is showing signs of peaking this year, which could further bolster demand for railcars.

In Summary:

Automotive is one of the strongest segments in the rail industry today and one in which Greenbrier plays a leading role. A cautious but healthy optimism for near-term equipment demand appears to be warranted given the current robust market fundamentals and macroeconomic outlook for the automotive sector.